Join Us Live for a Discussion on Medicare, Democracy, and the Future of Health Care

Medicare Advantage Proliferation: Too Much of a Complicated Thing

- Positions and Publications

Medicare Advantage (MA) has grown significantly in recent years. While it provides an alternative coverage pathway for people with Medicare, there are important tradeoffs with Original Medicare that many beneficiaries may not fully understand, such as a more limited selection of providers and prior authorization or other barriers to care.[i]

As more and more plans have entered the market, these decisions become even more complicated. While many people are drawn by MA’s promise of supplemental benefits on top of OM’s coverage,[ii] they often struggle to evaluate and compare plans.[iii] This is important because a poor fit between what a plan offers and what an individual needs can lead to delays in care, higher out-of-pocket costs, and barriers to chosen providers. And once in MA, beneficiaries may find themselves unable to afford a switch back to Original Medicare because of outdated Medigap rules in most states.[iv] Despite the gravity of these consequences, there are few quick remedies.

Alongside plan growth, MA enrollment has also surged, from 31% in 2014 to 54% in 2024.[v] This trendline is expected to continue; the Congressional Budget Office (CBO) projects the share of beneficiaries enrolled in MA will hit 64% by 2034.[vi] Absent policymaker intervention, ever more people will experience the pitfalls of the current program.

The Cluttered Plan Landscape

Over the past decade, the number of MA plans has increased sharply, and many MA organizations offer multiple plans per county.[vii] In 2018, the average person with Medicare had 21 plans to choose from, from an average of six MA organizations; in 2024, that number is 43, from an average of eight organizations.[viii]

Companies can offer so many plans because there are no longer rules to prevent them from doing so. Historically, the Centers for Medicare & Medicaid Services (CMS) required companies to show a “meaningful difference” between various plan offerings to avoid having nearly identical plans in a market, “to ensure a proper balance between affording beneficiaries a wide range of plan choices and avoiding undue beneficiary confusion in making coverage selections.”[ix] Under that standard, CMS only approved MA organization bids if they were “substantially different from those of other plans offered by the organization in the area with respect to key plan characteristics such as premiums, cost sharing, or benefits offered.”[x] The agency noted that “[r]esearch studies indicate that consumers, especially elderly consumers, may be challenged by a large number of plan choices that may: (1) result in not making a choice, (2) create a bias to not change plans, and (3) impact MA enrollment growth.”[xi]

Nevertheless, in 2019, CMS eliminated the meaningful difference requirement,[xii] arguing that doing so would promote “competition, innovation, available benefit offerings, and provide beneficiaries with affordable plans that are tailored for their unique health care needs and financial situation.”[xiii] They noted at that time that they “expect[] organizations to continue designing plan benefit packages that, within a service area, are different from one another with respect to key benefit design characteristics, so that any potential beneficiary confusion is minimized when comparing multiple plans offered by the organization.”[xiv]

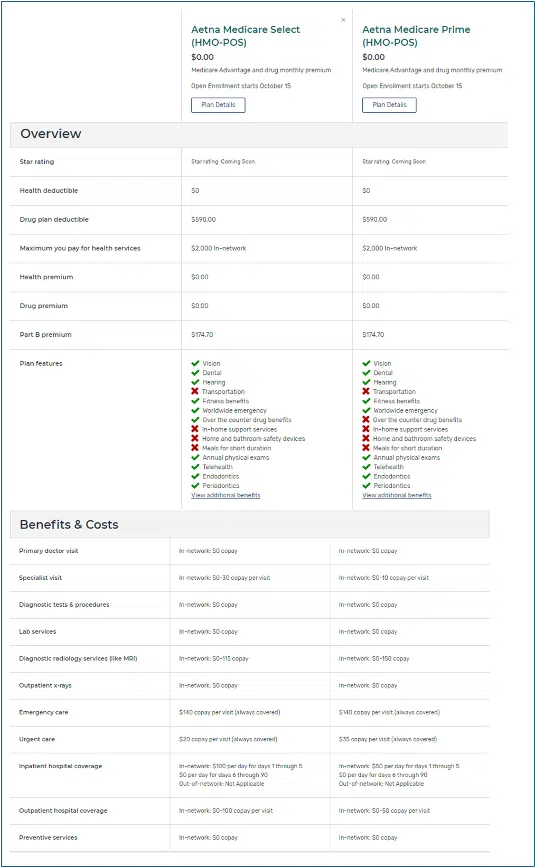

In theory, plans would still be distinct. In practice, this change has allowed MA organizations to have plans that differ only in their supplemental benefits or in slight cost-sharing differences for certain services. For example, there are 25 MA plans available in the Nevada zip code 89178. Aetna offers 10 of these plans, and, as seen below, two of the plans are astonishingly similar, even once drugs and pharmacies are included.[xv] We note that it is possible that the plans have different networks, but this information is not available through Medicare Plan Finder. Instead, people searching for plans must consult with each plan’s network directory, which is likely to be riddled with errors,[xvi] reach out to the plans directly, or contact each of their providers to see which plans they participate in.[xvii]

Even deciding between plans that have significant differences can prove challenging, especially if there are dozens. Unfortunately, causing “choice overload” may be part of MA organizations’ strategy. By flooding the market with plans, including “affinity plans” that target specific populations,[xviii] insurers may garner a larger percentage of new enrollees simply through greater exposure[xix] and, as discussed below, may push potential enrollees to turn to brokers or agents who may have financial ties to specific carriers.[xx] Flooding may also help retain enrollees by making switching plans daunting or by giving other options to prevent enrollees from straying too far. People rarely switch plans; even when they do, they tend to stick with the same insurer.[xxi] Insurers with multiple offerings can then better retain even consumers who are willing to switch plans.

High Profits Draw Plan Participation

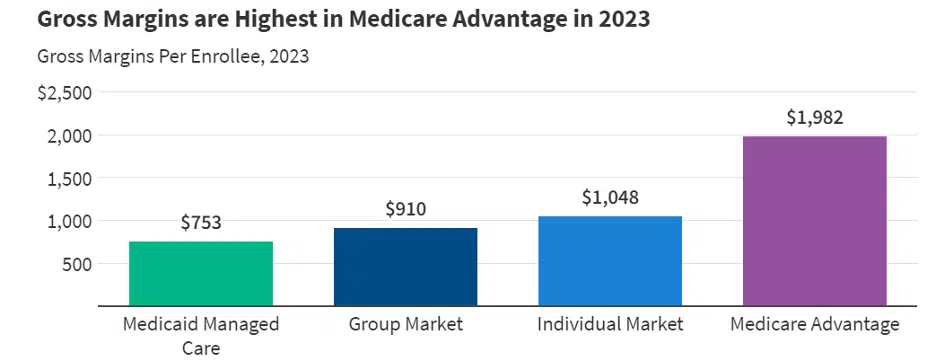

This sharp increase in plan numbers is tied to sky-high profit margins. It makes business sense to enter markets with high profit margins, and MA is that market. For example, in 2023, MA plans had gross margins over twice those of Medicaid managed care plans and group market plans, such as most employer plans.[xxii]

Figure 1 Source: KFF, “Health Insurer Financial Performance in 2023.”

Much of the profitability of MA plans is driven by enormous overpayment. Researchers suggest that MA is garnering hundreds of billions in overpayments from favorable selection, upcoding, and other policy choices.[xxiii]

How to Choose?

Plans can vary on everything from costs to coverage, and some of the differences can be subtle, as shown above. For most people, the need to analyze dozens of options and a flood of details can be overwhelming.[xxiv]

For that reason, people with Medicare need accurate and easily understood information, and often, individualized assistance. Although there are federally funded resources to help, like Medicare Plan Finder, 1-800-Medicare, and State Health Insurance Assistance Program (SHIP) counselors,[xxv] this assistance often goes unused.[xxvi] Studies suggest some of these tools are considered slow and cumbersome, while others, especially SHIPs, are unfamiliar.[xxvii]

Ultimately, these dynamics—a cluttered plan landscape, a lack of usable information, and inadequate decision-making tools—can make it impossible for beneficiaries to determine what plan is the best fit.[xxviii] And few people with Medicare try.[xxix] Studies show that consumers who are older or have limited English proficiency, cognitive impairments, serious health needs, or inadequate internet access are the least likely to review and change their coverage.[xxx] This can lead to higher than expected costs, restricted provider access, burdensome prior authorization and other utilization management requirements, and delayed care.

There is often no easy fix for enrollees. If an enrollee makes a mistake, they may be stuck for up to a year in a plan that does not meet their needs.[xxxi] And switching back to Original Medicare may not be a comfortable option for some. Medigap,[xxxii] which protects against runaway out-of-pocket liability, is only accessible for some beneficiaries within strict enrollment windows,[xxxiii] and 20% of MA enrollees chose MA explicitly for the out-of-pocket cap, so having Original Medicare without supplemental coverage is precisely what they were trying to avoid.[xxxiv]

These factors push many people to seek outside help when they are trying to choose between coverage options. Some may rely on the experiences of their neighbors or friends, even when they have disparate needs and preferences. Worse, they may rely on deceptive marketing that is designed to lure them with empty promises.[xxxv]

Independent analysis has found that most people who received help choosing between their coverage options turned to brokers and agents.[xxxvi] But these sources of information may be biased in ways that do not align with the beneficiary’s best interest, even if some beneficiaries do not object.[xxxvii] And the current payment system gives them substantial reasons to push clients toward MA. Brokers and agents earn commissions when they enroll people into MA—and may earn extra through side deals that can include “administrative” bonuses[xxxviii] and pay for health risk assessments[xxxix]—but earn nothing if a person remains in Original Medicare alone. Standalone Part D or Medigap plans do pay commissions, but less than MA.[xl] In 2025, the standard commission for MA plans will be $626 (with some states as high as $780), compared to $109 for standalone Part D.[xli] Medigap commissions are generally a percentage of the plan premium[xlii] which can range from around $30 per month to hundreds depending on the state, the age of the insured, the plan type, and how the plan price is determined.[xliii]

Discussion

MA insurance companies want to maximize enrollment, and a cluttered plan landscape does not appear to keep beneficiaries from enrolling, but it might keep them from enrolling in the best plan for their needs. Curtailing MA overpayment would cut back on plan profits,[xliv] reducing one incentive for companies to create an abundance of new products. This is clear from trends for 2025, where insurers claim to be reducing MA footprints due to lower (but still wildly overpaid) profit margins.[xlv] But policymakers can do more to directly attack the problems associated with too much choice.

CMS could reinstate meaningful difference requirements to keep companies from flooding the market with plans that are hard to tell apart.

Plan standardization would make decisions easier and less risky. There is precedent for such an approach. Medigap plans are standardized to facilitate comparison,[xlvi] and CMS is beginning to address plan overload in the Affordable Care Act Marketplace coverage, including by offering standardized plans and increased discussion of meaningful differences between plans.[xlvii]

In addition to easing plan evaluations, offering standardized plans would advance equity by making it easier for CMS, consumers, advocates, and researchers to identify and prevent discriminatory benefit designs, such as plans that leave individuals with particular conditions or medication needs with substantial out-of-pocket costs.

Broker payment reforms and other regulatory steps could reduce some of the incentives to enroll beneficiaries in plans that do not suit their needs, and stronger marketing guardrails could also help protect beneficiaries and support informed decision-making.

People need more, and better, information. As recommended by MedPAC, Medicare should provide a notice to people who are approaching Medicare eligibility about their coverage options, enrollment timelines, and responsibilities.[xlviii] CMS materials must reflect beneficiaries’ primary decision-making considerations and clearly explain the differences between OM and MA, as well as the tradeoffs of each and implications for Medigap access.

Decision tools also need more work. Medicare Plan Finder is a valuable resource, but it lacks important features; for example, Plan Finder does not allow people to search for plans by provider, one of the most important considerations for many people when they seek a plan.

In addition, funding for Medicare enrollment help, like SHIP counselors, has failed to keep pace with inflation.[xlix] SHIPs are highly trained on Medicare’s complexities. They are often the only source of objective, one-on-one counseling available to help beneficiaries find the coverage that best meets their needs. Despite surging Medicare enrollment and an increasingly complex coverage landscape, the program remains woefully underfunded.

Beyond enrollment complexity, the growth in MA plan and enrollment numbers is also concerning because the data are unclear when it comes to MA quality and value.[l] It is evident that MA enrollment is growing, but data are lacking on how MA is working for those it is supposed to serve; in particular, networks, utilization management practices, and supplemental benefits data are hard to access. Without these and other data points, it is impossible to know how well MA works, especially for people in underserved communities. This, in turn, makes it impossible for beneficiaries to make fully informed enrollment choices or for policymakers to hold MA plans accountable for their spending, promises, and behaviors.[li]

More should also be done to ensure that choosing an MA plan once does not lock beneficiaries in forever. This can include adding an out-of-pocket limit in OM and creating more access for Medigap coverage for those who worry about limitless liability.[lii]

Too much choice can baffle and confuse people into making decisions that are not the best for their individual circumstances or can drive them away from making any decisions at all. In the case of Medicare Advantage, one mistaken coverage choice can lead to huge financial penalties and an ongoing inability to back out of a warped system. More must be done to ensure that all Medicare coverage options are transparent, understood, high-quality, and affordable.

This work was supported in part by Arnold Ventures. Medicare Rights Center maintains full editorial control over all of its policy analysis and communications activities.

Endnotes

[i] Medicare Rights Center, “Comparing Original Medicare and Medicare Advantage” (July 17, 2023), https://www.medicarerights.org/policy-documents/comparing-original-medicare-and-medicare-advantage.

[ii] Faith Leonard, et al., “Traditional Medicare or Medicare Advantage: How Older Americans Choose and Why” (October 17, 2022), https://www.commonwealthfund.org/publications/issue-briefs/2022/oct/traditional-medicare-or-advantage-how-older-americans-choose.

[iii] Nancy Ochieng, et al., “Nearly 7 in 10 Medicare Beneficiaries Did Not Compare Plans During Medicare’s Open Enrollment Period” (September 26, 2024), https://www.kff.org/medicare/issue-brief/nearly-7-in-10-medicare-beneficiaries-did-not-compare-plans-during-medicares-open-enrollment-period/.

[iv] Medicare Rights Center, “Access to Medicare Supplemental Insurance Policies (Medigaps)” (March 1, 2023), https://www.medicarerights.org/policy-documents/access-to-medicare-supplemental-insurance-policies-medigaps.

[v] Meredith Freed, et al., “Medicare Advantage in 2024: Enrollment Update and Key Trends” (August 28, 2024), https://www.kff.org/medicare/issue-brief/medicare-advantage-in-2024-enrollment-update-and-key-trends/.

[vi] Id.

[vii] Meredith Freed, et al., “Medicare Advantage 2024 Spotlight: First Look” (November 15, 2023), https://www.kff.org/medicare/issue-brief/medicare-advantage-2024-spotlight-first-look/.

[viii] Meredith Freed, et al., “Medicare Advantage 2024 Spotlight: First Look” (November 15, 2023), https://www.kff.org/medicare/issue-brief/medicare-advantage-2024-spotlight-first-look/.

[ix] 82 Fed. Reg. 56336, 56363.

[x] 82 Fed. Reg. 56336, 56363.

[xi] 82 Fed. Reg. 56336, 56363.

[xii] 83 Fed. Reg. 16440, 16490.

[xiii] 82 Fed. Reg. 56336, 56363.

[xiv] 82 Fed. Reg. 56336, 56363.

[xv] This comparison was done twice on October 2, 2024. The first, pictured, used three commonly prescribed generic drugs at Plan Finder’s default dosage for each drug: Lisinopril 10 mg, Simvastatin 20 mg, and Metformin hydrochloride 500 mg twice daily. A second comparison was run using name-brand medications Ozempic, Jardiance, and Eliquis. The costs in the second scenario increased but the plans remained matched. For pharmacies, the first three pharmacies in the zip code offered by Plan Finder were selected and show the same network status for both plans.

[xvi] See, Centers for Medicare & Medicaid Services, “Online Provider Directory Review Report” (January 19, 2018), https://www.cms.gov/Medicare/Health-Plans/ManagedCareMarketing/Downloads/Provider_Directory_Review_Industry_Report_Year2_Final_1-19-18.pdf; Senate Committee on Finance, “Majority Study Findings: Medicare Advantage Plan Directories Haunted by Ghost Networks” (May 3, 2023), https://www.finance.senate.gov/imo/media/doc/050323%20Ghost%20Network%20Hearing%20-%20Secret%20Shopper%20Study%20Report.pdf.

[xvii] Medicare Rights urges all potential enrollees to consult with their providers before choosing plans. Unfortunately, even this step may not guarantee network participation for the whole year.

[xviii] Stephanie Stephens, “New Medicare Advantage plans tailor offerings to Latinos, Asian Americans and LGBTQ+ people” (September 25, 2023), https://www.latimes.com/business/story/2023-09-25/medicare-advantage-plans-asian-americans-latinos-lgbtq-people; Yanlei Ma, et al., “Medicare Advantage Plans With High Numbers Of Veterans: Enrollment, Utilization, And Potential Wasteful Spending” (November 2024), https://www.healthaffairs.org/doi/full/10.1377/hlthaff.2024.00302; Adam L Beckman, et al., The Rise and Risks of Medicare Advantage “Affinity Plans” (March 20, 2024), https://jamanetwork.com/journals/jama/article-abstract/2816439; Harvard TH Chan School of Public Health, “Viewpoint: Questioning Medicare Advantage ‘affinity plans’” (April 4, 2024), https://hsph.harvard.edu/news/viewpoint-questioning-medicare-advantage-affinity-plans/.

[xix] Faith Leonard, et al., “Traditional Medicare or Medicare Advantage: How Older Americans Choose and Why” (October 17, 2022), https://www.commonwealthfund.org/publications/issue-briefs/2022/oct/traditional-medicare-or-advantage-how-older-americans-choose.

[xx] Faith Leonard, et al., “The Challenges of Choosing Medicare Coverage: Views from Insurance Brokers and Agents” (February 28, 2023), https://www.commonwealthfund.org/publications/2023/feb/challenges-choosing-medicare-coverage-views-insurance-brokers-agents; Riaz Ali & Lesley Hellow, “Agent Commissions in Medicare and the Impact on Beneficiary Choice”(October 12, 2021), https://www.commonwealthfund.org/blog/2021/agent-commissions-medicare-and-impact-beneficiary-choice.

[xxi] Adam Atherly, et al., “Switching Costs in Medicare Advantage,” Forum for Health Economics & Policy (July 2020), https://www.ncbi.nlm.nih.gov/pmc/articles/PMC10214015/.

[xxii] Jared Ortaliza, et al., “Health Insurer Financial Performance in 2023” (July 2, 2024), https://www.kff.org/medicare/issue-brief/health-insurer-financial-performance/. For more on MA payment and overpayment, see, e.g. Medicare Payment Advisory Commission, “Medicare Payment Policy: Report to the Congress,” (March 2022), https://www.medpac.gov/wp-content/uploads/2022/03/Mar22_MedPAC_ReportToCongress_SEC.pdf; Medicare Rights Center, “The Overpayment Cycle: Payments to Medicare Advantage” (July 17, 2023), https://www.medicarerights.org/policy-documents/the-overpayment-cycle-payments-to-medicare-advantage.

[xxiii] Medicare Rights Center, “Medicare Advantage 101” (July 17, 2024), https://www.medicarerights.org/policy-series/medicare-advantage-101.

[xxiv] Meredith Freed, et al., “What Do People with Medicare Think About the Role of Marketing, Shopping for Medicare Options, and Their Coverage?” (September 20, 2023), https://www.kff.org/report-section/what-do-people-with-medicare-think-about-the-role-of-marketing-shopping-for-medicare-options-and-their-coverage-report/#overwhelming_process.

[xxv] State Health Insurance Assistance Program, “Local Medicare Help” (last visited March 20, 2024), https://www.shiphelp.org/.

[xxvi] Nancy Ochieng, et al., “Nearly 7 in 10 Medicare Beneficiaries Did Not Compare Plans During Medicare’s Open Enrollment Period,” Appendix table 4 (September 26, 2024), https://www.kff.org/report-section/nearly-7-in-10-medicare-beneficiaries-did-not-compare-plans-during-medicares-open-enrollment-period-appendix/.

[xxvii] Meredith Freed, et al., “What Do People with Medicare Think About the Role of Marketing, Shopping for Medicare Options, and Their Coverage?” (September 20, 2023), https://www.kff.org/report-section/what-do-people-with-medicare-think-about-the-role-of-marketing-shopping-for-medicare-options-and-their-coverage-report/#overwhelming_process (“Further, most focus group participants had not heard of or used State Health Insurance Assistance Programs (SHIPs), which provide local, in-depth, and objective insurance counseling to people on Medicare.”)

[xxviii] Alison Rizer, “Is Too Much Choice a Bad Thing?” (July 23, 2021), https://atiadvisory.com/resources/is-too-much-choice-a-bad-thing/.

[xxix] See, e.g., Meredith Freed, et al., “More Than Half of All People on Medicare Do Not Compare Their Coverage Options Annually,” Kaiser Family Foundation (October 29, 2020), https://www.kff.org/medicare/issue-brief/more-than-half-of-all-people-on-medicare-do-not-compare-their-coverage-options-annually/; Wyatt Korma, et al., “Seven in Ten Medicare Beneficiaries Did Not Compare Plans Past Open Enrollment Period,” Kaiser Family Foundation (October 13, 2021), https://www.kff.org/medicare/issue-brief/seven-in-ten-medicare-beneficiaries-did-not-compare-plans-during-past-open-enrollment-period/.

[xxx] Nancy Ochieng, et al., “Nearly 7 in 10 Medicare Beneficiaries Did Not Compare Plans During Medicare’s Open Enrollment Period” (September 26, 2024), https://www.kff.org/medicare/issue-brief/a-relatively-small-share-of-medicare-beneficiaries-compared-plans-during-a-recent-open-enrollment-period/.

[xxxi] Medicare Advantage enrollees do have an annual enrollment period running from January 1 through March 31 that they can use to switch to another MA plan or to Original Medicare. See, e.g., Medicare Interactive, “How to switch Medicare Advantage Plans or switch from Medicare Advantage to Original Medicare” (last visited September 27, 2024), https://www.medicareinteractive.org/get-answers/medicare-health-coverage-options/changing-medicare-coverage/how-to-switch-medicare-advantage-plans-or-switch-from-medicare-advantage-to-original-medicare.

[xxxii] Medicare Interactive, “Medigap overview” (last visited October 3, 2024), https://www.medicareinteractive.org/get-answers/medicare-health-coverage-options/supplemental-insurance-for-original-medicare-medigaps/medigap-overview.

[xxxiii] Medicare Rights Center, “Access to Medicare Supplemental Insurance Policies (Medigaps)” (March 1, 2023), https://www.medicarerights.org/policy-documents/access-to-medicare-supplemental-insurance-policies-medigaps.

[xxxiv] Faith Leonard, et al., “Traditional Medicare or Medicare Advantage: How Older Americans Choose and Why” (October 17, 2022), https://www.commonwealthfund.org/publications/issue-briefs/2022/oct/traditional-medicare-or-advantage-how-older-americans-choose.

[xxxv] U.S. Senate Committee on Finance, “Deceptive Marketing Practices Flourish in Medicare Advantage” (November 3, 2022), https://www.finance.senate.gov/imo/media/doc/Deceptive%20Marketing%20Practices%20Flourish%20in%20Medicare%20Advantage.pdf.

[xxxvi] Faith Leonard, et al., “Traditional Medicare or Medicare Advantage: How Older Americans Choose and Why” (October 17, 2022), https://www.commonwealthfund.org/publications/issue-briefs/2022/oct/traditional-medicare-or-advantage-how-older-americans-choose.

[xxxvii] Meredith Freed, et al., “What Do People with Medicare Think About the Role of Marketing, Shopping for Medicare Options, and Their Coverage?” (September 20, 2023), https://www.kff.org/report-section/what-do-people-with-medicare-think-about-the-role-of-marketing-shopping-for-medicare-options-and-their-coverage-report/#overwhelming_process.

[xxxviii] 88 Fed. Reg. 78476, 78552.

[xxxix] Faith Leonard, et al., “The Challenges of Choosing Medicare Coverage: Views from Insurance Brokers and Agents” (February 28, 2023), https://www.commonwealthfund.org/publications/2023/feb/challenges-choosing-medicare-coverage-views-insurance-brokers-agents.

[xl] Riaz Ali and Lesley Hellow, “Agent Commissions in Medicare and the Impact on Beneficiary Choice.” The Commonwealth Fund (October 12, 2021). https://www.commonwealthfund.org/blog/2021/agent-commissions-medicare-and-impact-beneficiary-choice.

[xli] Roxanne Anderson, “2025 Maximum Broker Commissions for Medicare Advantage & Medicare Part D.”

(July 1, 2024), https://ritterim.com/blog/2025-maximum-broker-commissions-for-medicare-advantage-and-medicare-part-d/.

[xlii] Riaz Ali and Lesley Hellow, “Agent Commissions in Medicare and the Impact on Beneficiary Choice.” The Commonwealth Fund (October 12, 2021). https://www.commonwealthfund.org/blog/2021/agent-commissions-medicare-and-impact-beneficiary-choice.

[xliii] Alex Rosenberg, “How Much Does a Medicare Supplement Insurance Plan Cost?” (June 19, 2024), https://www.nerdwallet.com/article/insurance/medicare/medigap-cost.

[xliv] Medicare Rights Center, “Medicare Advantage 101” (July 17, 2024), https://www.medicarerights.org/policy-series/medicare-advantage-101.

[xlv] Bruce Japsen, “For 2025, Insurers Pull Back Slightly On Medicare Advantage Footprints” (October 01, 2024), https://www.forbes.com/sites/brucejapsen/2024/10/01/for-2025-insurers-pull-back-slightly-on-medicare-advantage-footprints/.

[xlvi] Centers for Medicare & Medicaid Services, “How to compare Medigap policies” (last visited August 30, 2022), https://www.medicare.gov/supplements-other-insurance/how-to-compare-medigap-policies.

[xlvii] Centers for Medicare & Medicaid Services, “HHS Notice of Benefit and Payment Parameters for 2024 Proposed Rule” (December 12, 2022), https://www.cms.gov/newsroom/fact-sheets/hhs-notice-benefit-and-payment-parameters-2024-proposed-rule.

[xlviii] Medicare Payment Advisory Commission, “Beneficiary enrollment in Medicare: Eligibility notification, enrollment process, and Part B late-enrollment penalties” (June 2019), https://www.medpac.gov/wp-content/uploads/import_data/scrape_files/docs/default-source/reports/jun19_ch1_medpac_reporttocongress_sec.pdf; Medicare Rights strongly supports the BENES 2.0 Act (S. 3675), which would effectuate this change. This commonsense, bipartisan bill would require the federal government to notify people approaching Medicare eligibility about basic enrollment rules, which would help prevent costly enrollment errors.

[xlix] Congressional Research Service, “State Health Insurance Assistance Program (SHIP)” (October 23, 2023), https://crsreports.congress.gov/product/pdf/IF/IF10623.

[l] Medicare Payment Advisory Commission, “Chapter 11: The Medicare Advantage program: Status report” (March 2023), https://www.medpac.gov/wp-content/uploads/2023/03/Ch11_Mar23_MedPAC_Report_To_Congress_SEC.pdf (“The current state of quality reporting is such that the Commission’s yearly updates can no longer provide an accurate description of the quality of care across MA plans.”).

[li] See, e.g., Gretchen Jacobson, et al., “Medicare Advantage Hospital Networks: How Much Do They Vary?” (June 2016), https://www.kff.org/report-section/medicare-advantage-hospital-networks-how-much-do-they-vary-results/; Qijuan Li, et al., “Medicare Advantage Ratings and Voluntary Disenrollment Among Patients With End-Stage Renal Disease,” Health Affairs (January 2018), https://www.healthaffairs.org/doi/10.1377/hlthaff.2017.0974; Momotazur Rahman, et al., “High-Cost Patients Had Substantial Rates of Leaving Medicare Advantage and Joining Traditional Medicare,” Health Affairs (October 2015), https://www.healthaffairs.org/doi/10.1377/hlthaff.2015.0272; Meredith Freed, et al., “Medicare Advantage in 2022: Premiums, Out-of-Pocket Limits, Cost Sharing, Supplemental Benefits, Prior Authorization, and Star Ratings,” Kaiser Family Foundation (August 25, 2022), https://www.kff.org/medicare/issue-brief/medicare-advantage-in-2022-premiums-out-of-pocket-limits-cost-sharing-supplemental-benefits-prior-authorization-and-star-ratings/.

[lii] Medicare Rights Center, “Access to Medicare Supplemental Insurance Policies (Medigaps)” (2023), https://www.medicarerights.org/pdf/medigap-access-factsheet-2023.pdf.

Recent Resources

Any changes to the Medicare program must aim for healthier people, better care, and smarter spending—not paying more for less. As policymakers debate the future of health care, we will provide our insights here.

Thinking ahead to Medicare's future, it’s important to modernize benefits and pursue changes that improve how people with Medicare navigate their coverage on a daily basis. Here are our evolving 30 policy goals for Medicare’s future.

You can help protect and strengthen Medicare by taking action on the important issues we are following, subscribe to newsletter alerts, or follow along on social media. Any way you choose to get involved is a contribution that we appreciate greatly.