Join Us Live for a Discussion on Medicare, Democracy, and the Future of Health Care

Medicare Advantage Enrollees Have Until March 31 to Make Certain Coverage Changes

The Medicare Advantage Open Enrollment Period (MA OEP) runs from January 1 through March 31 each year. Unlike the annual Fall Open Enrollment Period, this window is limited to people currently enrolled in MA (excluding those with Medical Savings Accounts, cost plans, and PACE). They can make one change only, either switching to a different MA plan or to Original Medicare, with or without Part D coverage.

MA OEP changes take effect on the first day of the following month. For example, if someone switches to a new MA plan in February, that coverage would begin March 1.

What Changes Are Allowed?

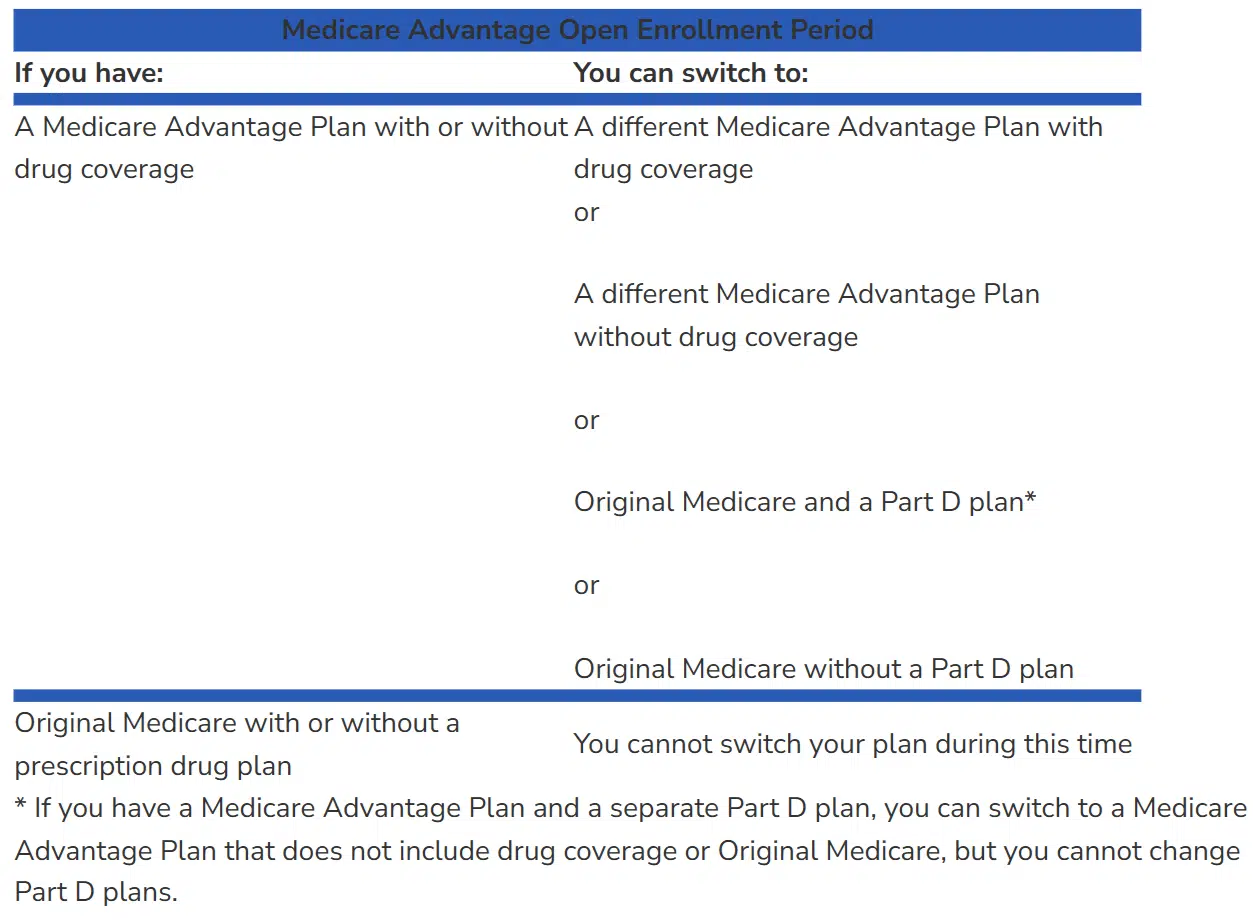

As the Medicare Interactive graphic below explains, people with MA plans (with or without drug coverage) can switch to another MA plan (with or without drug coverage) or return to Original Medicare, with the option to join a separate Part D plan.

There is one important, if rare, limitation: MA enrollees who get their drug coverage through a standalone Part D plan can only switch to an MA plan that does not include drug coverage or to Original Medicare; they cannot change Part D plans during the MA OEP. This situation, where someone has separate MA and Part D plans, is very unusual – the vast majority of MA plans (89%) include prescription drug coverage.

What About Medigap?

Medigaps are health insurance policies that work with Original Medicare and pay part or all of certain remaining costs such as deductibles, coinsurance, and copayments after Original Medicare pays first. There are federally protected times when someone can purchase a Medigap. But outside of these protected times, companies can refuse to sell Medigap policies, impose certain medical requirements, charge a higher monthly premium, and/or require a six-month waiting period before the Medigap will cover pre-existing conditions.

Outside of protected times, companies can refuse to sell Medigap policies, impose certain medical requirements, and/or charge a higher premium.

People who want to leave their MA plan and enroll in Original Medicare should contact Medigap insurers in their state to learn if they can purchase a Medigap policy. You can also check with your local State Health Insurance Assistance Program (SHIP) to learn about your state’s rules.

How to Enroll in a New Plan

The best way to enroll in a new plan is via the Medicare Plan Finder website or by calling 1-800-MEDICARE (1-800-633-4227). Plan Finder can help you compare MA and prescription drug costs across plans in your area, taking into consideration the drugs you take and the pharmacies you use. To confirm plan information you read online, call the plan directly and always write down everything about the conversation, including the date, name of the representative you spoke to, and any outcomes.

In 2026, people who enroll directly through the online Medicare platform will be given a Special Enrollment Period if they relied on incorrectly listed network information.

Enrolling directly through these official Medicare platforms can protect you in case you receive incorrect information from Medicare sources or run into problems with your plan. In 2026, to account for changing plan information on Plan Finder, people who enroll directly through the online platform will be given a Special Enrollment Period if they relied on incorrectly listed network information. If you choose to contact an MA plan directly to make changes, make sure you submit disenrollment and enrollment requests at the same time to avoid errors.

Where to Go for Help

- Your local SHIP provides free, highly trained, one-on-one, unbiased Medicare assistance. There are 54 SHIPs (one in each of the 50 states, Puerto Rico, Guam, the District of Columbia, and the U.S. Virgin Islands). Visit www.shiphelp.org and click on the orange “Find local Medicare help” button in the upper right corner to contact your SHIP.

- You can also go directly to Medicare through Medicare Plan Finder or by dialing 1-800-MEDICARE.

- Medicare Rights can provide additional assistance, answering your questions and troubleshooting issues you may have. Call our national helpline at 800-333-4114.

Show Comments

We welcome thoughtful, respectful discussion on our website. To maintain a safe and constructive environment, comments that include profanity or violent, threatening language will be hidden. We may ban commentors who repeatedly cross these guidelines.

Help Us Protect & Strengthen Medicare

Donate today and make a lasting impact

More than 67 million people rely on Medicare—but many still face barriers to the care they need. With your support, we provide free, unbiased help to people navigating Medicare and work across the country with federal and state advocates to protect Medicare’s future and address the needs of those it serves.

The Latest

Most Read

Add Medicare to Your Inbox

Sign up to receive Medicare news, policy developments, and other useful updates from the Medicare Rights.

View this profile on InstagramMedicare Rights Center (@medicarerights) • Instagram photos and videos