Join Us Live for a Discussion on Medicare, Democracy, and the Future of Health Care

People with Medicare Should Compare Medicare Advantage and Part D Plans Each Year

Medicare Open Enrollment begins tomorrow, October 15, giving people with Medicare the option to shop for new coverage for the coming year. But many beneficiaries do not compare plans and may find themselves with coverage that is too expensive or not suited for their needs.

This week, the Kaiser Family Foundation (KFF) released a new report showing that 71% of beneficiaries did not compare their Medicare Advantage (MA) plan options. The drug plan shares were even worse, with 81% of those in MA drug plans and 72% of those in traditional Medicare with stand-alone drug plans not reviewing their coverage. Some of this may be because beneficiaries are overwhelmed due to the proliferation of plans. According to KFF’s report, in 2021, the average person with Medicare has 33 MA plans and 30 stand-alone Part D plans to compare.

Those who are content with their coverage do not have to make a change during Open Enrollment, but everyone with Medicare should at least look over all of their insurance information, including all supplemental coverage such as Medigaps, to make sure it is the best coverage for their circumstances. For unbiased, one-on-one help, people can contact their local State Health Insurance Assistance Program (SHIP).

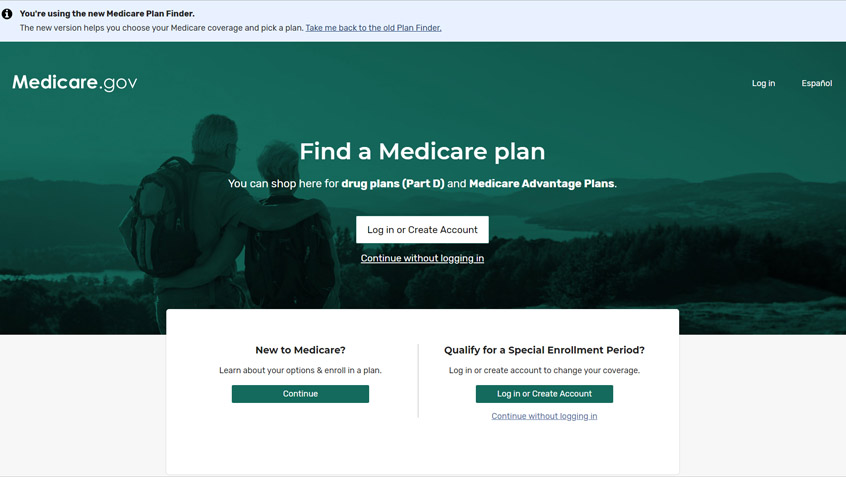

In preparation for Open Enrollment, the Centers for Medicare & Medicaid Services (CMS) released updated star ratings to help people shop for and compare MA and Part D plans on the Medicare Plan Finder. Both MA and Part D plans can change every year. These changes can include cost-sharing and premiums, pre-authorization rules, covered drugs or formularies, supplemental benefits, quality as shown in star ratings, and which providers are covered in the networks. Each of these is an important consideration for those who are in or contemplating joining MA or Part D plans.

At Medicare Rights, we continue to urge CMS to make the Plan Finder easier to use but also to reduce the complexity of choices beneficiaries face. We want to see fewer, high-quality plans with standardized benefits and formularies to reduce the burden and the risk of making mistakes during Open Enrollment.

Show Comments

We welcome thoughtful, respectful discussion on our website. To maintain a safe and constructive environment, comments that include profanity or violent, threatening language will be hidden. We may ban commentors who repeatedly cross these guidelines.

Help Us Protect & Strengthen Medicare

Donate today and make a lasting impact

More than 67 million people rely on Medicare—but many still face barriers to the care they need. With your support, we provide free, unbiased help to people navigating Medicare and work across the country with federal and state advocates to protect Medicare’s future and address the needs of those it serves.

The Latest

Most Read

Add Medicare to Your Inbox

Sign up to receive Medicare news, policy developments, and other useful updates from the Medicare Rights.

View this profile on InstagramMedicare Rights Center (@medicarerights) • Instagram photos and videos