Join Us Live for a Discussion on Medicare, Democracy, and the Future of Health Care

Congressional Budget Office Final Score: Reconciliation Bill Increases Deficit by 3.4 Trillion; Causes 10 Million to Lose Health Insurance

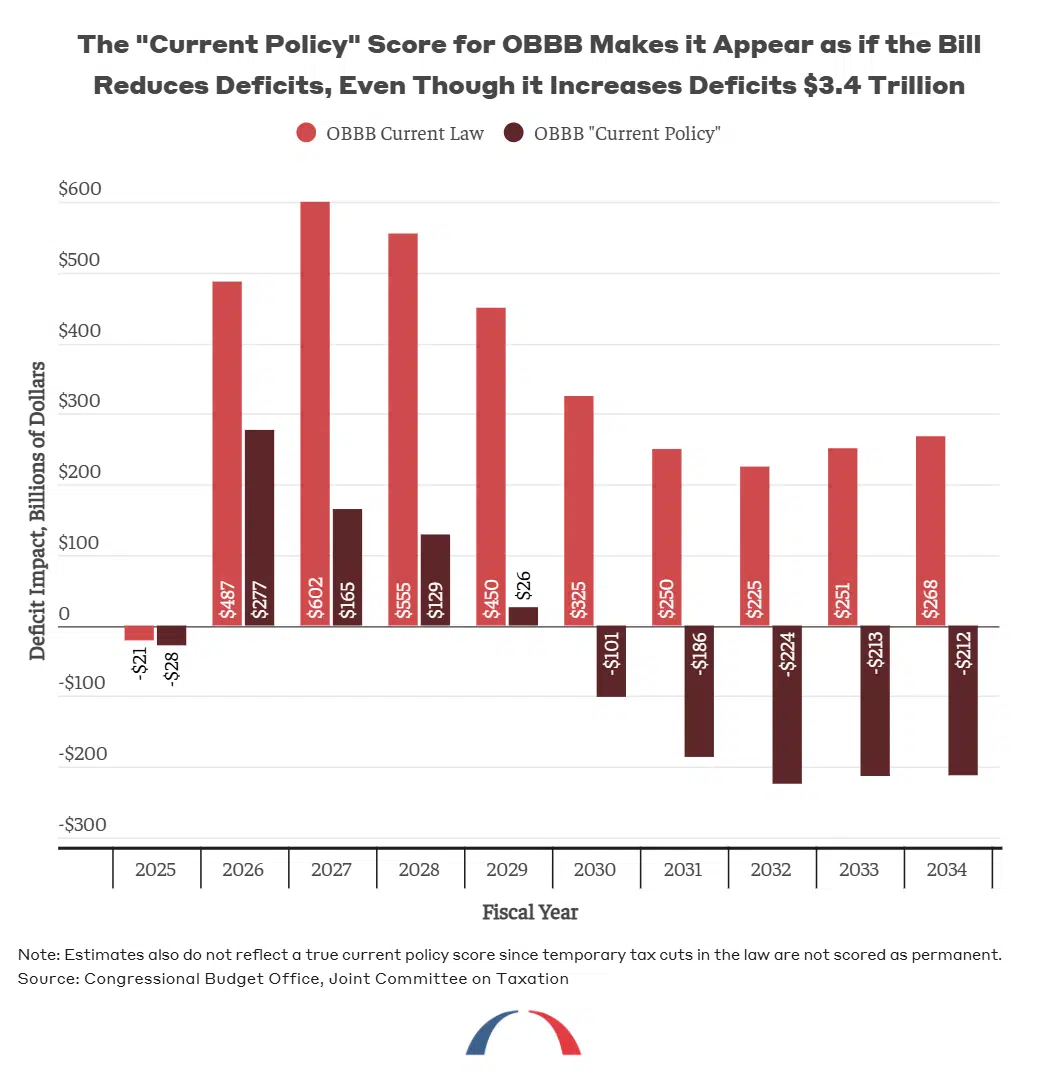

This week, the Congressional Budget Office (CBO) released updated cost estimates of the recently enacted One Big Beautiful Bill Act (OBBBA), reflecting the final provisions. The score finds that between now and 2034, the law will add $3.4 trillion to the deficit and cause more than 10 million people to lose health insurance.

Although not reflected in the CBO report, an additional five million people are expected to become uninsured when the Affordable Care Act’s enhanced tax credits end later this year. Unlike other expiring tax breaks, the credits were not extended in the bill.

What’s in (and Not in) a Score?

The CBO and the Joint Committee on Taxation (JCT), both nonpartisan institutions working for Congress, are the official scorekeepers in Washington. They are charged with tallying the projected spending, revenue, deficit, and debt effects of legislation into a score.

Scores are the modeler’s best estimate for how the specific legislation will affect spending and revenue over a specified time period

Scores are not crystal balls—they cannot foretell all impacts a law will have on government spending and revenue with perfect accuracy. Importantly, they don’t attempt to predict or take into account future legal or legislative changes. Instead, they are the modeler’s best estimate for how the specific legislation will affect spending and revenue over a specified time period—usually 10 years.

The Comparator Is Key

In order to determine how a law will impact spending or revenue, it is critical to set a point of comparison, known as a “baseline,” relative to which the legislation’s changes and costs are measured. In the reconciliation bill, Republican lawmakers wanted to extend many of the policies from the 2017 Tax Creation and Jobs Act (TCJA) that were set to expire on December 31, 2025, including 3.8 trillion dollars in tax cuts. To do so, they used an accounting trick. They argued that, in evaluating the OBBBA, they could use a “current policy” baseline: comparing the world in which the law exists to one where the status quo in 2025 continued for 10 years. The problem with this approach is the fact that, absent legislative action, the 2025 status quo would not actually continue. So the “current policy baseline” was an inflated number, making the OBBBA appear to have a lower price tag.

The “current policy baseline” was an inflated number, making the OBBBA appear to have a lower price tag.

Although a baseline built on this fiction was attractive to Republican lawmakers because it allowed them to continue the 2017 tax cuts without paying for them, ignoring reality doesn’t change it. The extended tax breaks do indeed come at a cost, exploding the deficit despite policymaker claims of fiscal responsibility. As experts at the Committee for Responsible Federal Budget note, “Many supporters of this law have spent months or years appropriately fuming about our unsustainable fiscal situation. But when they actually had an opportunity to fix it, they instead made it $4 trillion worse.”

As illustrated in the below chart created by the Bipartisan Policy Center, the two baseline accounting methods result in dramatically different estimates of the bill’s impact on the deficit.

The latest CBO estimates confirm the OBBBA will have serious and long-lasting consequences. Alongside program cuts and coverage losses, the bill balloons the national debt. Doing so jeopardizes Medicare’s outlook by setting significant, automatic cuts in motion, and by creating a funding hole that lawmakers could use as an excuse to pursue even deeper cuts in the future. Both the new law and the dynamics it creates are unacceptable. Medicare Rights remains committed to minimizing and reversing these harms.

Read the CBO report.

Show Comments

We welcome thoughtful, respectful discussion on our website. To maintain a safe and constructive environment, comments that include profanity or violent, threatening language will be hidden. We may ban commentors who repeatedly cross these guidelines.

Help Us Protect & Strengthen Medicare

Donate today and make a lasting impact

More than 67 million people rely on Medicare—but many still face barriers to the care they need. With your support, we provide free, unbiased help to people navigating Medicare and work across the country with federal and state advocates to protect Medicare’s future and address the needs of those it serves.

The Latest

Most Read

Add Medicare to Your Inbox

Sign up to receive Medicare news, policy developments, and other useful updates from the Medicare Rights.

View this profile on InstagramMedicare Rights Center (@medicarerights) • Instagram photos and videos

4 Comments on “Congressional Budget Office Final Score: Reconciliation Bill Increases Deficit by 3.4 Trillion; Causes 10 Million to Lose Health Insurance”

Eric Johansen

July 25, 2025 at 12:14 amPure evil.

R M

July 25, 2025 at 12:28 pmThe billionaires are “calling the shots” in America and ordinary citizens have no voice. The decision makers and their financiers need to pay up in taxes or tax on assets. A billionaire can live comfortably for years on $100 million post-tax… The billionaires need to pay tax to pay down the national debt due to their decisions.

Steven Stewart

July 28, 2025 at 10:19 amThe deficit is a Bi-Partisan Problem. Don’t act like the Biden administration didn’t create almost 8 trillion in debt during his term. As did Trump his first term 7 trillion. There is a lot of fraud, waste, and abuse going on in Medicare and Medicaid. There are millions receiving these benefits that shouldn’t be receiving these benefits. Taking advantage of the system. Many, fully capable of working. There are millions of illegals on these benefits as well and as a taxpayer, these individuals are not our responsibility. People also don’t realize that if Congress grants amnesty to 20 million illegals, they are able to bring their kids, parents, and grandparents to the states. With just a average of 5 individual per family, that puts 100 million people into the states almost immediately. Medicare and Medicaid are already struggling to stay afloat. And all for all those crying about the billionaires, there are plenty on the democrat side like Bill Gates, George Soros and his son, Warren Buffett and many more!!!

Also, the CBO is often wrong and what they don’t tell you about the deficits created span over years which is still bad. If you don’t want to have deficits, you have to make cuts which doesn’t make everyone happy.

Jackie Grace

July 29, 2025 at 10:39 amYou sound just like Trump. You need to educate yourself before you put things out in print.