Join Us Live for a Discussion on Medicare, Democracy, and the Future of Health Care

New Report Captures Medicare Part D in 2018, Identifies Long-Term Trends

A recent report from the Kaiser Family Foundation (KFF) examines Medicare Part D data from the Centers for Medicare & Medicaid Services (CMS). The resulting analysis presents findings on Part D enrollment, premiums, and cost-sharing in 2018, as well as key trends over time.

Here are some of the key trends:

Part D enrollment continues to grow. The number of people enrolled in Part D has grown steadily since the program started in 2006. In 2018, 43 million of the 60 million people with Medicare have prescription drug coverage under a Medicare Part D plan. Of these enrollees, most (58%) are covered under a stand-alone prescription drug plan (PDP), but a growing share (42%) are in Medicare Advantage prescription drug plans (MA-PDs).

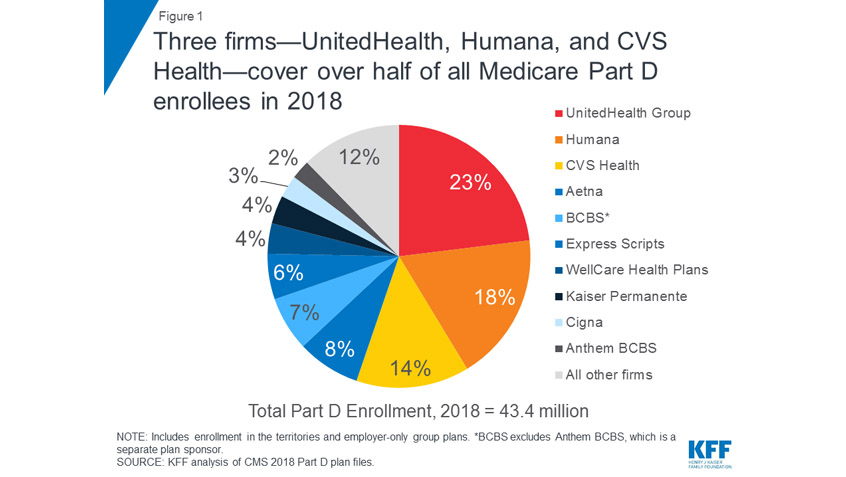

Three Part D plans cover a majority of people with Medicare. In 2018, three health insurance companies—UnitedHealth, Humana, and CVS Health—account for over half (55%) of all Part D (PDP and MA-PD) enrollees, and two-thirds (67%) of all PDP enrollees. Notably, the proposed mergers of CVS Health and Aetna, and Cigna and Express Scripts would result in further consolidation of the Part D marketplace.

Premiums continue to increase. PDP enrollees are in plans with an average monthly premium of $41 in 2018—a relatively modest 2% increase over 2017, but an 11% increase over 2015. Premiums for seven of the 10 most popular PDPs increased in 2018, and continue to vary widely—ranging from $20 per month for Humana Walmart Rx to $84 per month for AARP Medicare Rx Preferred. Of the top five PDPs, plans with premium increases from 2017 to 2018 unsurprisingly saw a decrease in enrollment while plans that decreased premiums saw higher enrollment.

Cost-sharing varies greatly for generic and brand name drugs. Most Part D enrollees face modest cost-sharing amounts for generic drugs, but can face much higher cost-sharing for brand name and non-preferred drugs, and a mix of copayments and coinsurance for different formulary tiers. For example, for PDP enrollees, the median cost-sharing amount ranges from $1 for preferred generics to $37 for preferred brands, and a 40-50% coinsurance rate for non-preferred drugs.

Many low-income beneficiaries pay a monthly premium, even though they may be able to obtain coverage with no premium. More than 12 million low-income Part D enrollees (29%) receive subsidies that help them afford Part D coverage. In 2018, 1.2 million of these Low Income Subsidy (LIS) enrollees pay an average monthly premium of $26—or more than $300 per year—even though they may be able to obtain Part D coverage without any premium. The average premium LIS enrollees pay in 2018 is up 13% from 2017 and is nearly three times the 2006 amount.

This report’s analysis of Medicare’s current climate and the program’s evolving landscape will be helpful to Medicare Rights’ near- and long-term advocacy, education, and outreach efforts. In particular, both the trends it identifies and the present-day snapshot it presents will be important as we continue to seek opportunities to engage older adults and people with disabilities and inform future policymaking. As always, our goal is to improve the program and empower people with Medicare to evaluate and obtain the best, most affordable coverage for their unique circumstances.

Show Comments

We welcome thoughtful, respectful discussion on our website. To maintain a safe and constructive environment, comments that include profanity or violent, threatening language will be hidden. We may ban commentors who repeatedly cross these guidelines.

Help Us Protect & Strengthen Medicare

Donate today and make a lasting impact

More than 67 million people rely on Medicare—but many still face barriers to the care they need. With your support, we provide free, unbiased help to people navigating Medicare and work across the country with federal and state advocates to protect Medicare’s future and address the needs of those it serves.

The Latest

Most Read

Add Medicare to Your Inbox

Sign up to receive Medicare news, policy developments, and other useful updates from the Medicare Rights.

View this profile on InstagramMedicare Rights Center (@medicarerights) • Instagram photos and videos