Join Us Live for a Discussion on Medicare, Democracy, and the Future of Health Care

Kaiser Family Foundation Brief Highlights Decline in Employer Sponsored Retiree Health Plans

According to a recent issue brief by the Kaiser Family Foundation (KFF), from 1988 to 2015 there was a considerable decrease in the number of large employers that offer retiree health coverage. In 1988, 66 percent of large employers with 200 or more employees offered retiree health benefits and just 23 percent of large employers offered these benefits in 2015.

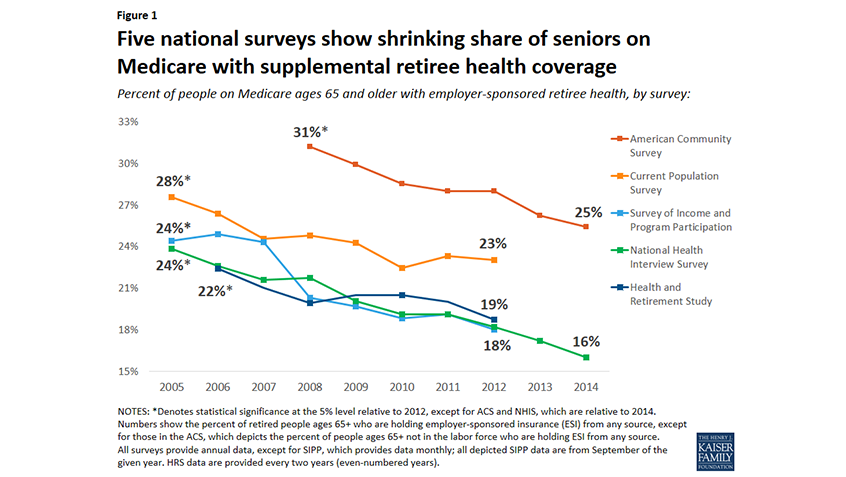

The overall trends clearly show the decline of the availability of retiree health plans. Drawing from five national surveys, KFF illustrates the substantive decrease in the share of older adults with Medicare and retiree health plans. The surveys vary with one showing a decline from 31 percent in 2008 to 25 percent in 2014 and another showing a decline from 24 percent in 2005 to 16 percent in 2004.

Employer-sponsored retiree health benefits help to fill gaps in Medicare coverage, and many retiree plans pay for some or all of the costs associated with Medicare, including premiums and deductibles. These plans can also provide a cap on out-of-pocket spending, which is particularly important for retirees in traditional Medicare who need costly care, as traditional Medicare does not have a cap of out-of-pocket costs.

Ten thousand people are enrolling in Medicare every day and many are doing so without supplemental coverage from a retiree health plan. KFF concludes that “…the drop in retiree health coverage has important implications for retiring boomers who are approaching their Medicare years with a different set of insurance needs and choices than their parents’ generation.”

Show Comments

We welcome thoughtful, respectful discussion on our website. To maintain a safe and constructive environment, comments that include profanity or violent, threatening language will be hidden. We may ban commentors who repeatedly cross these guidelines.

Help Us Protect & Strengthen Medicare

Donate today and make a lasting impact

More than 67 million people rely on Medicare—but many still face barriers to the care they need. With your support, we provide free, unbiased help to people navigating Medicare and work across the country with federal and state advocates to protect Medicare’s future and address the needs of those it serves.

The Latest

Most Read

Add Medicare to Your Inbox

Sign up to receive Medicare news, policy developments, and other useful updates from the Medicare Rights.

View this profile on InstagramMedicare Rights Center (@medicarerights) • Instagram photos and videos